Running a business, whether small or large, is a journey filled with opportunities and risks. While most entrepreneurs focus on growth strategies, customer acquisition, and product development, many overlook a critical safety net: business insurance. Operating without this essential layer of protection can expose your business to significant financial losses, legal challenges, and even permanent closure.

This comprehensive article explores the true cost of skipping business insurance and why every company—regardless of size—should consider it a foundational aspect of operations.

Key Takeaways

- Not having business insurance exposes you to lawsuits, property damage, and regulatory fines.

- The right insurance policies provide financial protection, peace of mind, and credibility.

- General liability, property, and worker’s compensation are the most common types.

- Insurance is a strategic investment that protects your business’s future.

- Regularly review and update your coverage as your business evolves.

Why Business Insurance Matters

Business insurance is more than a regulatory requirement—it’s a strategic asset. It protects your company from unexpected events like lawsuits, property damage, employee injuries, cyberattacks, and natural disasters. These incidents can drain your resources and stall your progress if you’re unprepared.

The Risks of Going Without Business Insurance

Financial Ruin from Lawsuits

Legal disputes are common in the business world. Whether it’s a customer who slips and falls or a competitor alleging trademark infringement, lawsuits can cost tens of thousands of dollars in legal fees alone. Without general liability insurance, these costs come directly out of your pocket.

Property Damage and Loss

Imagine a fire or flood destroying your office, equipment, or inventory. Property insurance can help replace or repair assets, but without it, you must bear the full cost. For many businesses, that’s enough to shut operations down permanently.

Employee Injuries and Worker’s Compensation

If an employee gets injured on the job, you’re legally and ethically responsible for their medical expenses and lost wages. Worker’s compensation insurance covers this, and going without it could result in heavy fines and lawsuits.

Cybersecurity Breaches

Data breaches and ransomware attacks can cost millions in damages, especially if customer data is compromised. Cyber insurance can protect you from legal liabilities and recovery expenses. Without it, the financial and reputational cost can be devastating.

Business Interruption

Natural disasters, fires, or other events may force your business to shut down temporarily. Business interruption insurance can replace lost income during these periods. Without it, you could face cash flow problems and customer loss.

Loss of Trust and Reputation

Customers and clients trust that your business is stable and reliable. If a crisis occurs and you’re uninsured, the inability to manage it can damage your reputation and customer confidence.

Non-Compliance Penalties

In some jurisdictions, certain types of business insurance (like workers’ comp or commercial auto insurance) are legally required. Not having them can result in hefty fines and even business license revocation.

Types of Business Insurance Every Company Should Consider

To avoid these risks, consider securing a combination of the following policies:

- General Liability Insurance: Covers bodily injuries and property damage.

- Property Insurance: Protects physical assets.

- Workers’ Compensation Insurance: Covers employee injuries.

- Professional Liability Insurance (Errors & Omissions): Ideal for service-based businesses.

- Cyber Liability Insurance: Covers data breaches and cyber threats.

- Business Interruption Insurance: Compensates for income lost during downtime.

- Commercial Auto Insurance: Necessary if you use vehicles for business.

- Product Liability Insurance: Important if you manufacture or sell goods.

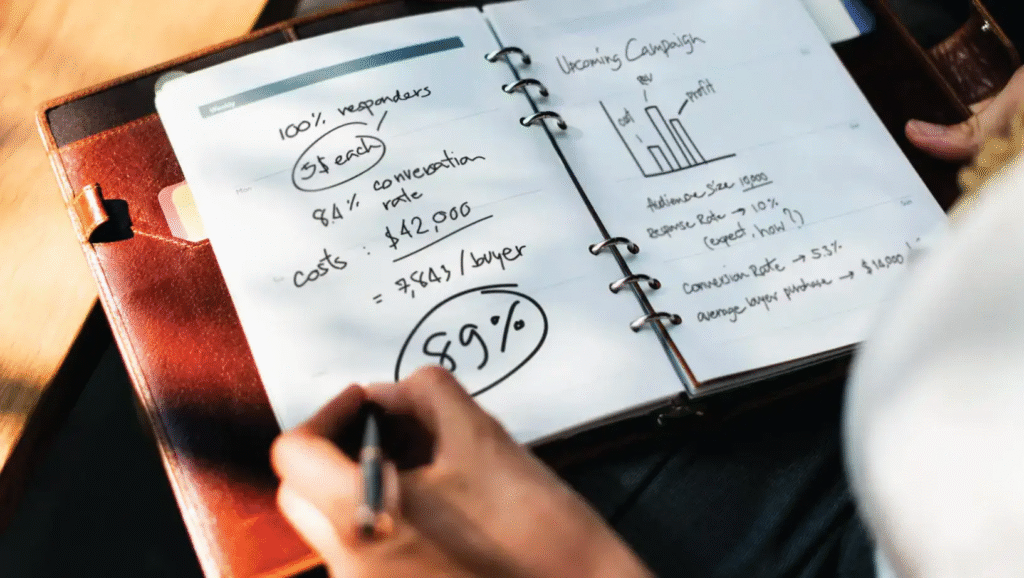

Case Study: A Business Without Insurance

Let’s consider a real-world example:

Business Name: GreenLeaf Landscaping, LLC

Scenario: The company skipped general liability insurance to save costs. One day, a client tripped over a misplaced tool on their property and broke their leg. The resulting lawsuit cost GreenLeaf $75,000 in medical and legal expenses, nearly bankrupting the business. Had they invested just $800 annually in liability insurance, this could have been avoided.

What Types of Business Insurance Does a Startup Really Need?

Description: Explore essential insurance policies tailored for startups, such as liability, cyber, and business owner’s policies (BOPs). Discuss cost-saving bundles and real examples of startup insurance pitfalls.

How Does Business Insurance Support Long-Term Growth?

Description: Go beyond risk management and show how insurance aids in stability, investor confidence, compliance, and strategic planning.

Is a Business Owner’s Policy (BOP) the Best Choice for Small Businesses?

Description: Break down what a BOP includes, how it saves money, and who it’s best for. Include comparisons with standalone policies.

Do Freelancers and Solopreneurs Need Business Insurance?

Description: Target self-employed individuals and explain the specific risks they face (e.g., liability, income loss, intellectual property claims).

Can Cyber Insurance Protect Your Business from Modern Threats?

Description: Focus on the rising cybercrime risk for businesses of all sizes. Cover costs of breaches, downtime, and client notification.

How to File a Business Insurance Claim Without Delays

Description: Step-by-step guide to help business owners understand the claims process, avoid denials, and reduce processing times.

What Insurance Do You Need When Expanding Your Business?

Description: Discuss coverage needs when opening new locations, hiring more employees, or adding new services/products.

Is Your Commercial Auto Insurance Policy Covering Enough?

Description: Evaluate typical gaps in commercial vehicle coverage and include tips on selecting limits, deductibles, and add-ons.

How Much Should You Budget for Business Insurance Annually?

Description: Provide detailed cost breakdowns by industry, business size, and location. Add tools or calculators to estimate premiums.

What Happens If Your Business Gets Sued Without Insurance?

Description: Use real or fictional case studies to demonstrate how uninsured businesses suffer reputational and financial collapse.

How to Build a Strong Business Insurance Strategy from Day One

Description:

This article would walk readers through the essential steps of planning their insurance coverage during the startup phase—identifying risks, choosing policies, estimating costs, and working with brokers. It will emphasize that building a foundation of protection early supports long-term growth and investor confidence.

What Are the Most Common Business Insurance Claims—And How Can You Avoid Them?

Description:

Highlight real-world data on frequently filed claims (e.g., slips and falls, data breaches, fire damage) and provide risk management tips to help businesses avoid them. Include industry-specific risks and examples of successful mitigation strategies.

Is Your Business Covered for the Unexpected? Hidden Gaps in Your Insurance Policy

Description:

Many businesses believe they’re fully covered when they’re not. This article would dive into common exclusions, underinsured areas (like flood damage or reputational harm), and how to review your policies with professionals to close those gaps.

Choosing Between a Business Owner’s Policy (BOP) and Custom Insurance: What’s Best for You?

Description:

A detailed comparison article exploring the pros and cons of BOPs vs. tailored insurance coverage. Include breakdowns by business size, budget, industry, and growth goals. Feature case studies and interviews with experts.

Is Business Insurance a Legal Requirement or Just a Smart Investment?

Description:

Explain the legal obligations for different types of businesses (employees, vehicles, contracts), and contrast them with the benefits of optional policies like cyber insurance. Position insurance as both a legal safeguard and financial strategy.

How Business Insurance Can Be Your Lifeline During Natural Disasters

Description:

Focus on how floods, earthquakes, fires, and storms can bring business to a halt and how specific insurance coverage—like property, business interruption, or equipment breakdown—can aid recovery and continuity.

Do You Understand Your Business Insurance Policy? A Guide to Reading the Fine Print

Description:

Educate business owners on how to read and understand the core sections of a business insurance policy: coverage limits, exclusions, deductibles, and conditions. Include sample policy visuals and FAQs.

How Much Business Insurance Do You Really Need? A Practical Cost-Benefit Analysis

Description:

Break down how to estimate your ideal coverage level using income, assets, employee risk, industry regulations, and potential liabilities. Include budgeting tips and sample calculation worksheets.

What Role Does Business Insurance Play in Securing Loans and Investments?

Description:

Explain how having robust insurance can improve your eligibility for business loans, impress investors, and reduce your risk profile in business valuations. Include real examples and testimonials from lenders.

What Happens During a Business Insurance Audit—and How Can You Prepare?

Description:

Detail the purpose and process of business insurance audits (especially for worker’s comp and liability policies), what documents to provide, and how to prevent premium adjustments or penalties.

How Business Insurance Impacts Your Financial Planning and Stability

Long Description:

This article explores the financial role of business insurance beyond risk coverage. Discuss how it can improve cash flow management, secure better loan terms, and safeguard capital investment. Break down real scenarios showing how insured businesses avoid financial collapse while uninsured ones struggle. Include expert quotes from financial planners or insurance advisors.

What Happens to a Business After a Major Loss Without Insurance?

Long Description:

Focus on the real aftermath of a business disaster—fires, lawsuits, cyberattacks—when insurance is not in place. Use detailed case studies or fictionalized stories to emphasize the ripple effects: operational downtime, employee layoffs, legal fees, client loss, and bankruptcy. Educate readers on how to conduct a risk audit and prepare with the right coverage.

Do You Need Different Insurance as Your Business Grows?

Long Description:

As a business evolves—from solo to small team to multi-location—its insurance needs shift. This article outlines how scaling impacts liability, employee coverage, data risk, and property concerns. Provide a timeline or checklist of when to upgrade or add policies based on key growth milestones.

Understanding Employer Liability: Are You Protected as You Hire More Staff?

Long Description:

Dive into how hiring introduces legal and financial risks—discrimination lawsuits, workplace injury, harassment claims, etc. Break down the types of insurance (employment practices liability, workers’ compensation, etc.) that protect businesses. Include legal compliance tips for each type of coverage.

How Cyber Insurance Saves Businesses in the Digital Age

Long Description:

As companies store more data and operate online, cyber insurance becomes essential. This article would explain what it covers (ransomware, data breach response, PR crises, fines) and how to choose the right policy. Include stats on data breach costs and prevention tips.

Is Your Business Legally Exposed Without the Right Insurance?

Long Description:

Explain the legal ramifications of going uninsured or underinsured. Cover compliance issues, state-mandated policies, and penalties. Include tips on avoiding legal traps and how to consult with insurance experts or lawyers to ensure full coverage.

Why Every Contractor and Service Provider Needs Business Insurance

Long Description:

Targeted at independent contractors, this piece would highlight common risks (equipment damage, injury, client disputes), types of relevant insurance (tools and equipment, professional liability, general liability), and real examples of lawsuits or claims. Emphasize client trust and contract compliance as key reasons to be insured.

How Business Insurance Influences Your Brand Reputation

Long Description:

This article would take a unique angle—how having the right insurance builds trust with clients, vendors, and investors. Show how businesses perceived as well-prepared and protected are more attractive to partnerships. Include testimonials or expert interviews.

Why Annual Insurance Reviews Are Crucial for Business Survival

Long Description:

Explain how failing to review policies can lead to costly coverage gaps as the business changes. Offer a yearly insurance review checklist, what to update (new assets, employees, services), and tips for negotiating better premiums or policy enhancements.

Business Continuity vs. Business Insurance: What’s the Difference and Why You Need Both

Long Description:

Clarify how business insurance and continuity planning work together. Highlight scenarios where insurance pays out, but without a continuity plan, recovery still fails. Include templates or outlines for creating a business continuity strategy that complements insurance coverage.

How to Choose the Right Business Insurance for Your Industry

Long Description:

Every industry has specific risks—tech startups face cyber threats, restaurants face fire and injury claims, and consultants risk client disputes. This article would offer an industry-by-industry guide (e.g., retail, construction, healthcare, IT services) showing which policies are critical for each and how to avoid overpaying for irrelevant coverage.

Why Skipping Business Interruption Insurance Can Be a Costly Mistake

Long Description:

Many businesses overlook this type of insurance, yet it’s often the most important during crises like natural disasters or pandemics. This article would explain how interruption insurance works, what it covers (lost income, rent, payroll), and give examples of businesses that survived vs. failed during disruptions—especially after COVID-19.

What Is Professional Liability Insurance and Who Really Needs It?

Long Description:

Many professionals—consultants, freelancers, designers, accountants—don’t realize they can be sued for mistakes or missed deadlines. This article would unpack professional liability (errors & omissions) coverage, with examples of claims and who should consider it.

How to Reduce Business Insurance Premiums Without Compromising Coverage

Long Description:

Provide actionable tips like bundling policies, increasing deductibles, improving workplace safety, or installing cybersecurity measures. Help business owners understand how risk management directly impacts their premiums and long-term costs.

The Role of Insurance in Franchise and Franchisee Business Models

Long Description:

This topic explores the unique insurance needs in franchising—how responsibilities are split between franchisor and franchisee, required policies, and typical franchise-related risks. Include tips for franchise buyers on how to avoid underinsurance and negotiate coverage during the franchise agreement.

Do You Need Business Insurance If You Work From Home?

Long Description:

Many remote entrepreneurs or home-based businesses assume their homeowners’ insurance is enough—this is rarely true. This article explores where home insurance ends and business insurance begins, covering client visits, equipment damage, and liability risks from running a business in your house.

How Often Should You Reassess Your Business Insurance Needs

Long Description:

This article would help readers develop a habit of annual insurance reviews. Cover what business changes (new services, hiring, location changes) trigger policy updates. Include a downloadable checklist or timeline to review policies at tax time or fiscal year-end.

How Insurance Brokers Help Small Businesses Get Better Coverage

Long Description:

Business owners often buy insurance without expert help and miss out on customized options or savings. This article explains how independent insurance brokers work, the value they provide, and how they compare policies across providers.

Understanding the Claims Process: What to Do When Disaster Strikes

Long Description:

This practical guide would explain what steps to take immediately after an incident—gathering evidence, notifying the insurer, documentation tips, and follow-ups. You can also include advice on avoiding common mistakes that delay or reduce payouts.

Why Business Insurance Is an Investment, Not an Expense

Long Description:

Shift the reader’s mindset. Instead of viewing insurance as a “cost,” help them understand it as a core business investment—protecting revenue, assets, reputation, and continuity. Compare it to other protective strategies like legal contracts or emergency Funds.

Also read : Which Travel Insurance Plan Is Right for You?

Conclusion

Skipping business insurance might save money in the short term, but it’s a gamble that rarely pays off. A single incident can wipe out years of hard work and capital investment. Whether you’re a startup founder or a seasoned entrepreneur, insurance is your safety net. It ensures that unexpected events don’t derail your progress or end your business journey prematurely.

FAQs

Do all businesses need insurance?

Yes. Every business, regardless of size or industry, faces risks that insurance can mitigate.

Is business insurance tax-deductible?

Yes, premiums for business insurance are generally considered a business expense and are tax-deductible.

How much does business insurance cost?

It varies based on the type of business, number of employees, coverage amount, and risks involved. Small businesses might pay anywhere from $500 to $5,000 annually.

What is the most important type of business insurance?

General liability insurance is a foundational policy that most businesses should start with.

Can I bundle different business insurance policies?

Yes, many insurers offer Business Owner’s Policies (BOPs), which bundle general liability, property, and other types of insurance at a discounted rate.

How often should I review my business insurance?

Annually, or whenever there are major changes in your operations, revenue, or employee count.

What happens if I delay getting insurance?

Every day without coverage increases your exposure to risks that could lead to financial loss, legal issues, or business failure.